Contents

Summary

MyFundedFutures, launched in September 2023, stands out in the world of proprietary trading firms. It allows futures traders to use simulated funds without risking their own capital, mirroring the model of its sister company, MyFundedFX.

Known for its success in forex trading, this evolution into futures trading is a natural progression. Key features highlighted in my MyFundedFutures review include the ability to pass in one day and the absence of activation fees, making it an appealing choice for ambitious traders embarking on their trading journey.

Keep reading to see if it is the right prop trading firm to take your trading career to the next level.

Pros & Cons

Pros

- Quick Evaluation: Ability to pass the evaluation in just one day.

- Keep Initial Profit: Traders keep the entire first $10,000 earned.

- High Profit Share: 90% profit share after the initial $10,000.

- Multiple Accounts: Option to use up to ten funded accounts simultaneously.

- Experienced Sister Company: MyFundedFutures is affiliated with a well-known forex prop firm My FundedFX, meaning they have substantial experience in funding.

Cons

- Limited Trading Options: Only futures trading is available, so if you are into trading other asset classes, you will have to look elsewhere.

- Professional Classification: Funded traders are considered professionals, leading to higher monthly costs for exchange data feeds.

- Restricted Support: Educational resources and customer support are somewhat limited.

External MyFundedFutures Reviews & Ratings

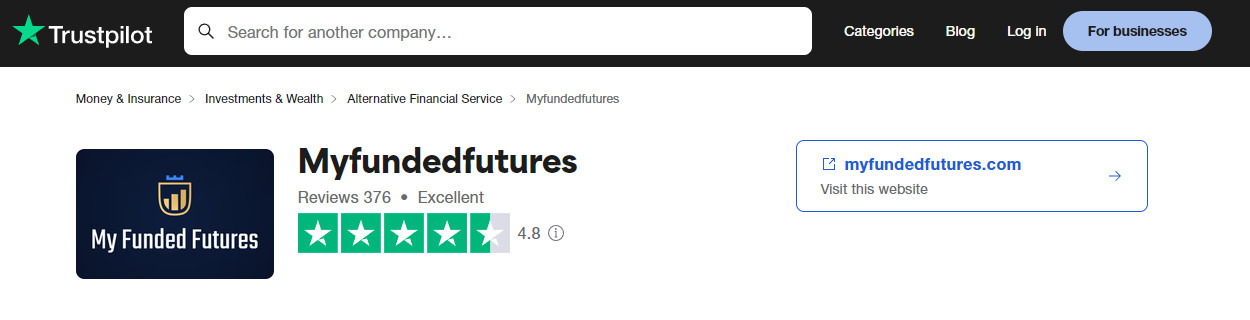

Although a relatively new prop firm, MyFundedFutures has already amassed lots of positive chatter online. MyFunded Futures has an excellent 4.8 out of 5 rating on TrustPilot.

MyFundedFutures Features

Here are the positive features I found with MyFundedFutures:

- Simulated Funds: Provides traders with simulated funds for futures trading, reducing the risk of using personal funds.

- Streamlined Evaluation: Offers a more efficient qualification process for traders. Allowing members to start trading sooner.

- Account Size Options: Offers various account sizes, including Starter and Expert plans. The flexibility of varied plans caters to the diverse needs of experienced traders wanting a higher initial balance, as well as consistent traders looking to leverage other people’s money to profit in the futures markets.

- Profit Sharing: Traders keep 100% of the first $10,000 in profits and 90% thereafter. This is one of the better splits offered in the prop trading industry.

- Futures Contract Variety: Supports trading across a broad range of futures contracts.

- Real Capital Trading: Enables trading with real capital after passing a one-step evaluation and receiving a funded account.

MyFundedFutures Review: The One Step Evaluation

MyFundedFutures has simplified its evaluation to a one-step challenge, distinguishing itself from other firms that typically use two-step processes.

This challenge phase involves a minimum trading day, requiring traders to demonstrate profit generation and risk management skills. Successful traders are then eligible for funding, allowing them to trade with real money and withdraw profits bi-weekly.

The unique aspect is that there’s just one minimum trading day required, and during the challenge, consistency rules are not applicable.

However, in the funded phase, a 40% consistency rule is applied, which means that profits from a single trading day shouldn’t exceed 40% of total profits, but this won’t lead to account termination.

The evaluation has three key requirements:

- Profit Target: This is dependent on account size, such as a $3,000 target for a $50K account. It’s important to note that single trades exceeding 40% of the target do not contribute to this goal.

- Consistency Target: There’s no consistency rule during the evaluation or for Expert plans, but in the simulated trading phase, the consistency rule stands at 40%.

- Daily Drawdown: Unique to MyFundedFutures, there are no daily drawdown limits. Instead, a maximum End of Day drawdown of 3% is set, like a $1,600 limit for a $50K account.

MyFundedFutures Alternatives

If you have read this far in this MyFundedFutures review and have concluded it isn’t the right trading platform for you don’t worry, there are other futures prop firms out there that might be a better fit.

Take Profit Trader is a user-friendly futures prop trading firm offering flexible trading rules and advantageous educational resources. To see how they are setting themselves apart in the funded trading space, check out my Take Profit Trader review.

In this comparing futures proprietary trading firms article, I break down all of the leading futures prop firms.

Final Thoughts

MyFundedFutures presents an intriguing opportunity for futures traders. Its streamlined evaluation process, the attractive profit-sharing model, and the flexibility offered by expert accounts are noteworthy features.

While it focuses exclusively on futures trading and has higher costs for professional traders, the platform’s benefits like multiple account options and connection to an experienced forex prop firm add significant value. For traders looking for a platform that balances risk with potential rewards and offers substantial growth opportunities, MyFundedFutures is certainly worth considering.

Interested in exploring what MyFundedFutures has to offer? Click Here to learn more and take your trading journey to the next level.

Get Start With MyFundedFutures >>