Contents

- I. Fund Information

- II. Fund products

- III. Frequently asked questions

- What is the maximum amount of capital I can manage?

- Can I trade EA/Script?

- What trading styles are prohibited by OFP?

- Am I allowed to trade news?

- Am I allowed to trade Stacking?

- Can I hold trades overnight, over the week?

- Am I allowed to Swing and Scalping?

- Can I merge accounts?

- Am I allowed to copy trades?

- Can I receive payments in Crypto?

- Are all OFP accounts live or demo?

- How much leverage does OFP have?

- What trading platforms does OFP have?

- Which broker does OFP use?

- What products can I trade?

- Can I request a refund after payment?

- What methods can I use to pay for OFP?

I. Fund Information

Overview What is Funding Program?

Overview Funding Program (OFP) is a UK-based funding fund, OFP launched its funding service in February 2022.

Based on the philosophy: “Trading is already a challenge, why add more challenges to traders?”

OFP has developed a service that is different from most other funding companies, specifically OFP provides instant funding accounts, you do not have to go through any challenges.

The presence of OFP helps the funding market have more diverse products and more choices for Funded Traders.

Contact Information

Website: https://ofpfunding.com/

Discord: https://discord.com/invite/ZsuPTtRBna

Email: [email protected]

Address: 71-75 Shelton Street London, UK

Advantages of OFP

– No funding challenge.

– Profit sharing immediately.

– No profit target.

Disadvantages

– Point value rule.

– No EA trading allowed.

Is OFP Funding reputable?

In addition, you can also refer to Traders’ reviews on Trustpilot.

II. Fund products

All OFP accounts require you to pay a one-time fee and keep the account until you violate the rules.

OFP has 2 types of accounts:

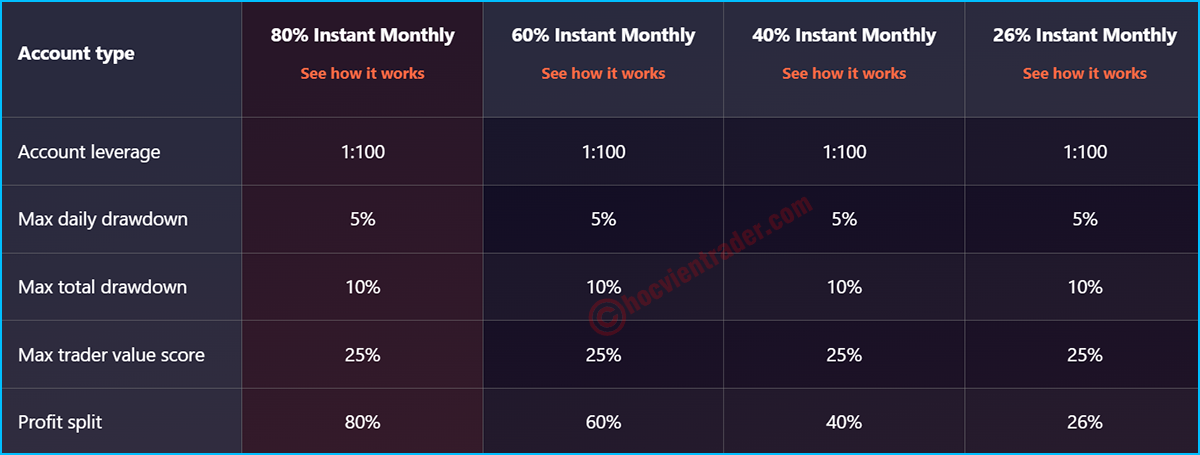

When joining an OFP account, there will be 2 main options you need to understand:

Profit withdrawal frequency: On Demand (withdraw at any time), Biweekly (once every 2 weeks), Monthly (once every 1 month).

Profit sharing ratio: 26%, 40%, 60%, 80%.

The higher the account benefits, the higher the fee you need to pay.

Features of Classic account are as follows:

In which:

– Account leverage: Account leverage.

– Max daily drawdown: Daily drawdown limit.

– Max total drawdown: Account drawdown limit.

– Max trader value score (TVS): Maximum profit value score.

– Profit split: Profit sharing ratio.

1.1. Drawdown Rules

Classic accounts must comply with 2 drawdown rules:

– Daily drawdown limit is 5%.

– Account drawdown limit is 10%.

For example

You join a $100,000 account.

The daily drawdown limit is 5% of the initial capital and is based on the highest Balance level of the day.

$100,000*5% = $5,000.

To understand better, we will consider some of the following cases:

#1.

At the beginning of the trading day, the account has a Balance = $100,000.

You trade and have no additional profit, the highest Balance level = $100,000.

$100,000 – $5,000 = $95,000.

During the day, you are not allowed to let the Equity of the account fall below $95,000.

#2.

At the beginning of the trading day, the account has a Balance of $100,000.

You trade at the beginning of the day with a profit of $2,000, then the highest Balance = $102,000.

$102,000 – $5,000 = $97,000.

At this point, you are not allowed to let the account’s Equity fall below $97,000.

#3.

At the beginning of the trading day, the account has a Balance of $97,000.

You trade at the beginning of the day with a profit of $4,000, then the highest Balance = $101,000.

$101,000 – $5,000 = $96,000.

At this point, you are not allowed to let the account’s Equity fall below $96,000.

Note:

With the calculation method based on the highest Balance of the day, you need to pay attention when you get the profit at the beginning of the day, it will lead to the daily loss limit being moved up. In other words, having more profit does not help you expand the daily loss range.

Drawdown limit is $10,000 (10% of initial capital)

$100,000 – $10,000 = $90,000.

You are not allowed to let your account Equity fall below $90,000 under any circumstances or it will result in a violation.

Note:

– Swing trading, news trading are allowed.

– OFP considers large differences in trade size as gambling and will not consider such trades in the profit payout.

– All trades must be closed before claiming a payout.

1.2. Trader value rule/Max trader value score (TVS)

Depending on the payment frequency, OFP requires different TVS scores for accounts.

For example:

If you choose the payment frequency as Monthly Payout, the TVS requirement will be 25%.

Trader value score = Best day*100%/Total profit

In which:

– Trader value score: Trader value score.

– Best day: The trading day with the largest profit in a cycle.

– Total profit: Total profit after a cycle.

For example: You join the Classic account and choose Monthly Payout, the TVS requirement is less than or equal to 25%.

#1.

You have a total profit of $2,500, the trading day with the largest profit is $500.

Trader value score = $500*100%/$2,500 = 20% < 25%

You have a safe score to make a withdrawal order. After withdrawing, the value score (TVS) will be reset.

#2.

You have a total profit of $2,500, the biggest profitable trading day is $1,000.

Trader value score = $1,000*100%/$2,500 = 40% > 25%.

You have a score exceeding 25% and violated this rule. This does not lead to account termination, it just means that you cannot withdraw money, you need to continue trading so that the score is less than or equal to 25%.

In this case, to get a safe score in the next trading cycle, you should keep the biggest profitable day of $1,000 and earn another $1,500 profit, then your total profit is $4,000.

Trader value score = $1,000*100%/$4,000 = 25%.

Thus, you have a safe score and meet the withdrawal conditions.

Or you can also pay 50% of the initial fee to request OFP Funding to reset the account, then TVS = 0.

1.3. Profit Withdrawal Policy

During the account purchase process, you choose the payment frequency, which will be the withdrawal time.

a. Monthly Payout

When you have profit, you are eligible to withdraw the first time after 28 days from the date of account purchase, the next payments are after 28 days from the previous payment date.

In addition, you need to meet the account value point less than or equal to 25%.

You receive the profit sharing % corresponding to your initial choice.

For example

You join the Classic account – 40% – Monthly Payout size $100,000.

After 28 days, your account increases to $110,000.

($110,000 – $100,000)*40% = $4,000.

The profit you receive is $4,000.

b. Biweekly Payout

In this option, you can withdraw your funds every 15 days, as long as your account value is less than or equal to 22%.

c. On Demand Payout

In this option, you can withdraw your funds at any time, as long as your account value is less than or equal to 20%.

1.4. Profit Withdrawal Methods

You can withdraw your profits via:

Bank transfer.

Crypto (LTC) – minimum requirement $25.

OFP takes an average of 7 hours to transfer payments depending on the withdrawal method.

1.5. Capital Expansion Policy

If you have a profit of 15% for 4 consecutive months (average 3.5%/month) you will be expanded by 25% of your initial capital.

Example

You join a $100,000 account.

$100,000*25% = $25,000.

1st Capital Expansion: $100,000 + $25,000 = $125,000

2nd Capital Expansion: $125,000 + $25,000 = $150,000

…

Nth Capital Expansion: Maximum £5,000,000.

2. Supercharged Account

OFP designed the Supercharged account to be much larger than the Classic account, but with a very small drawdown limit and leverage.

Below are the basic differences between Classic and Supercharged accounts.

From the table above you can see, to clearly compare the advantages between these two types of accounts, you need to choose a Supercharged account with a size 10 times larger than the Classic account, then they will have the same decline.

For example: We will choose the Classic account – $100,000 – Monthly Payout and the Supercharged account – $1,000,000 – Monthly Payout for detailed comparison.

Apart from the feeling of managing a large amount of capital for Traders, the Supercharged account actually has no advantage over the Classic account.

On the contrary, the Supercharged account requires you to pay a higher fee than the Classic account with equivalent benefits.

On the other hand, the Supercharged account has the same drawdown limit calculation, value rules, and withdrawal policy as the Classic account.

Note: The above comparison fee is taken at the present time, it can be adjusted by OFP over time.

III. Frequently asked questions

What is the maximum amount of capital I can manage?

OFP allows you to manage a maximum of $300,000 across all account types.

Supercharged accounts are leveraged 1:10.

For example:

You can participate in up to:

01 Classic account $200,000 and 01 Supercharged account $1,000,000

The maximum capital is: $200,000 + ($1,000,000:10) = $300,000.

Can I trade EA/Script?

No, you are not allowed to trade EA/Script. Your account will be suspended if you trade using EA/Script.

What trading styles are prohibited by OFP?

OFP strictly prohibits fraudulent trading, here is a list of prohibited styles in OFP’s program:

Gap trading.

Latency arbitrage, long-short arbitrage, reverse arbitrage.

Reverse/opposite account trading, Hedging, Tick scalping/trading, Martingale Trading.

News straddling methods (no pending orders allowed to trade news – Order Limit).

While this list is not exhaustive of all strategies that may violate OFP policy, these are the most common strategies that OFP observes traders attempting to exploit demo accounts.

If any account is found to be using unfair strategies or unrealistic trading styles, the account will be suspended.

Am I allowed to trade news?

Yes, news trading is allowed.

However, you are not allowed to place pending orders to trade news, you need to use direct orders (market orders) to enter the market.

The time limit is 2 minutes before and after the release of important news (total 4 minutes).

Note: You can still use pending orders to trade outside the 4 minute limit, important news have a red folder icon in ForexFactory.

Am I allowed to trade Stacking?

Yes, you are allowed to trade Stacking.

Can I hold trades overnight, over the week?

Yes, you are allowed.

Am I allowed to Swing and Scalping?

Yes, you are allowed to Swing and Scalping.

Can I merge accounts?

No, OFP does not allow account merging, however you can copy trades between accounts.

Am I allowed to copy trades?

Yes, OFP only allows copying between OFP accounts.

You are not allowed to copy from other personal/funding company accounts to OFP accounts.

If you copy from any third-party accounts, your account will be suspended immediately.

To copy between OFP accounts, you need to contact their support team and provide the following information:

1. Main account number, signal receiving account number.

2. Copying software (e.g. FX Blue, Trader Social Tools).

Can I receive payments in Crypto?

Yes, you can withdraw profits in LTC (litecoin), the minimum withdrawal amount via LTC is $25.

You can also pay fees in LTC to OFP.

Are all OFP accounts live or demo?

Does OFP provide demo accounts.

How much leverage does OFP have?

OFP offers 1:100 leverage.

What trading platforms does OFP have?

You can choose MT5 or Match Trader.

Which broker does OFP use?

OFP accounts are provided with liquidity by Blackbull Market broker.

What products can I trade?

You can trade: Currencies, Indices, Commodities, Cryptocurrencies.

To see the details of trading products and spreads, you can log in to your account with the following information:

Trading Platform: MT5

Login: 585819

Password: Mk8ifgv1@

Server: BlackBullMarkets-Demo

How long can I keep my account?

You can keep your account as long as you break the rules.

Can I request a refund after payment?

Yes, you can request a refund within 4 days of purchasing the account.

The account must not have made any transactions.

What methods can I use to pay for OFP?

You can pay for OFP using the following methods:

– Credit/Debit Card.

– Crypto (LTC, USDC, BTC, ETH).

IV. Registration and Payment Instructions

To join the OFP fund, click here

You click on “Open Account”

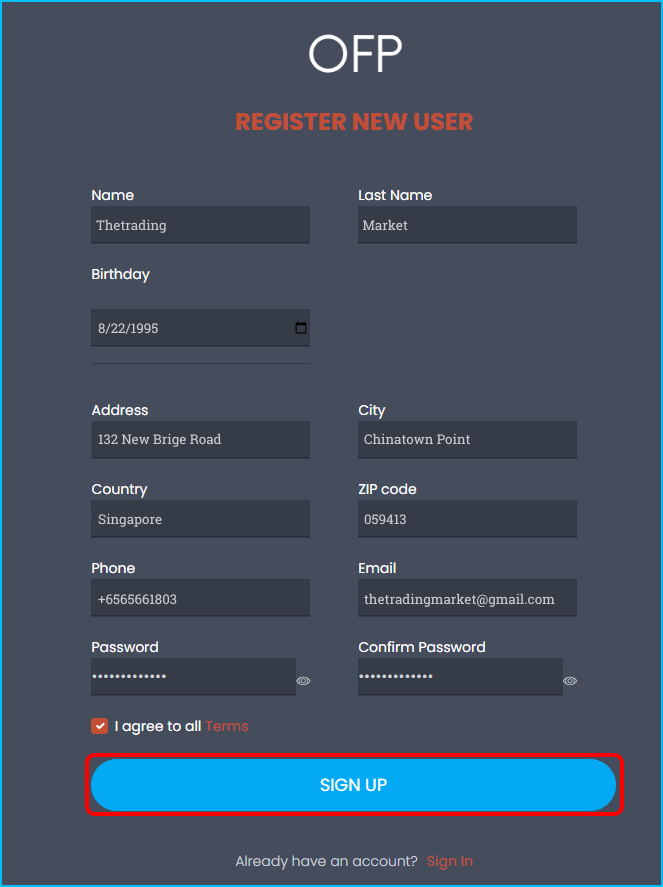

Here, you fill in: full name, address, email, set a password, click to agree to the terms and click “SIGN UP“

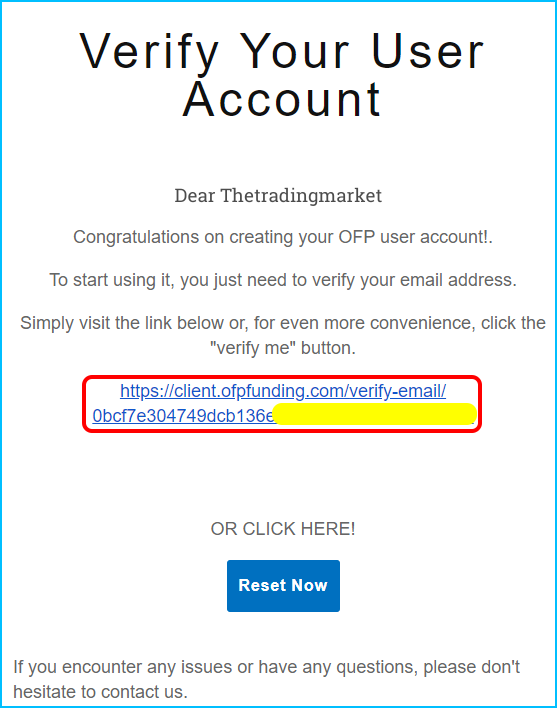

OFP will send you an email to verify that this email is yours.

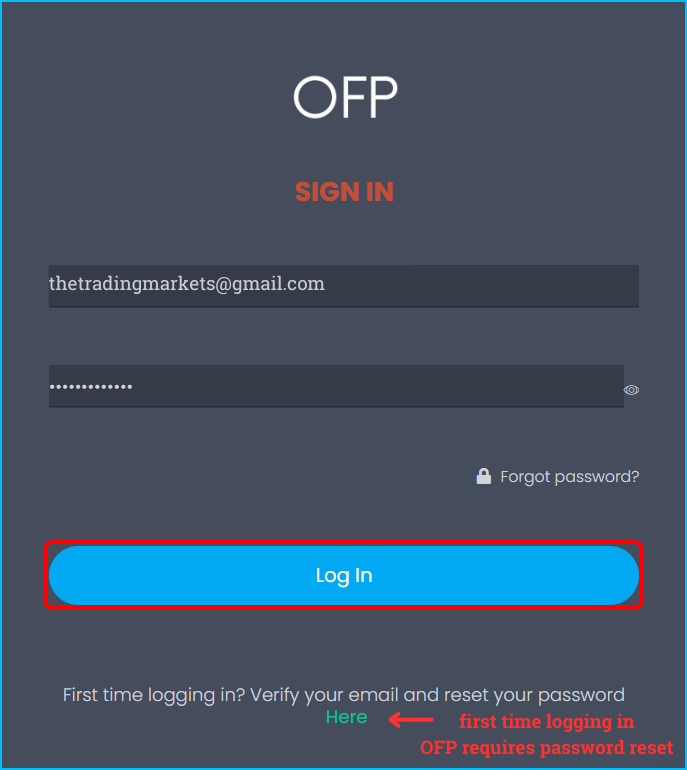

You click on the email confirmation link. Next, you log in to your account.

Enter your email and password, then click “Log In”.

Note: The first time you log in, OFP will ask you to reset your password.

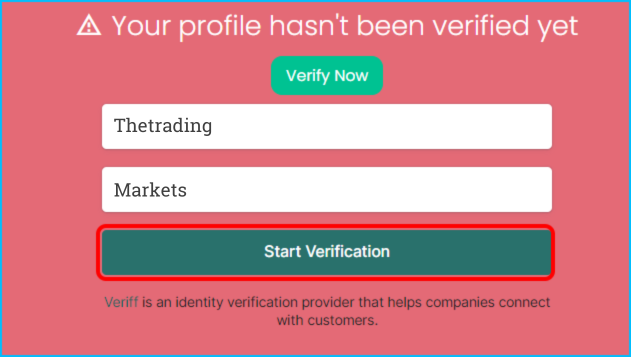

A red notification appears, asking you to verify your identity, fill in your full name and click “Start Verification“

In this step, you use your phone to scan the QR code and proceed with verification.

OFP’s verification process is quite simple, you just need to take a photo of your citizen identification (driver’s license, passport) along with a Selfie photo.

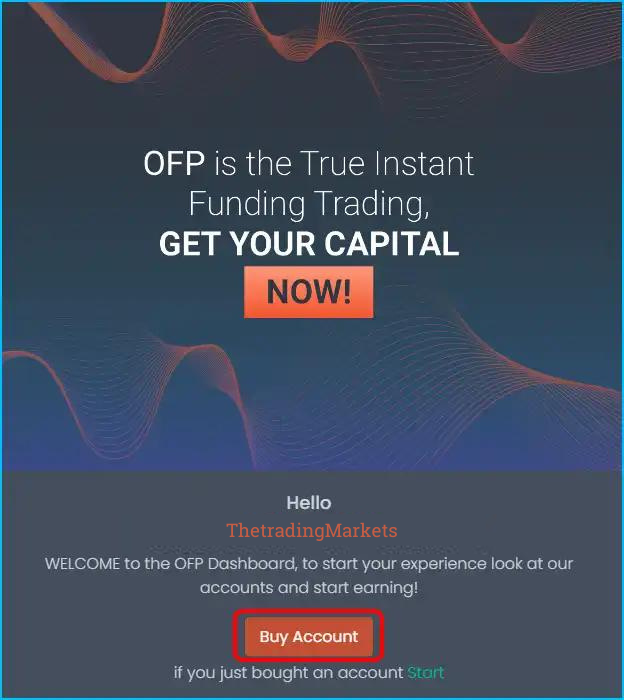

Verification complete, to buy an account click on “Buy Account“

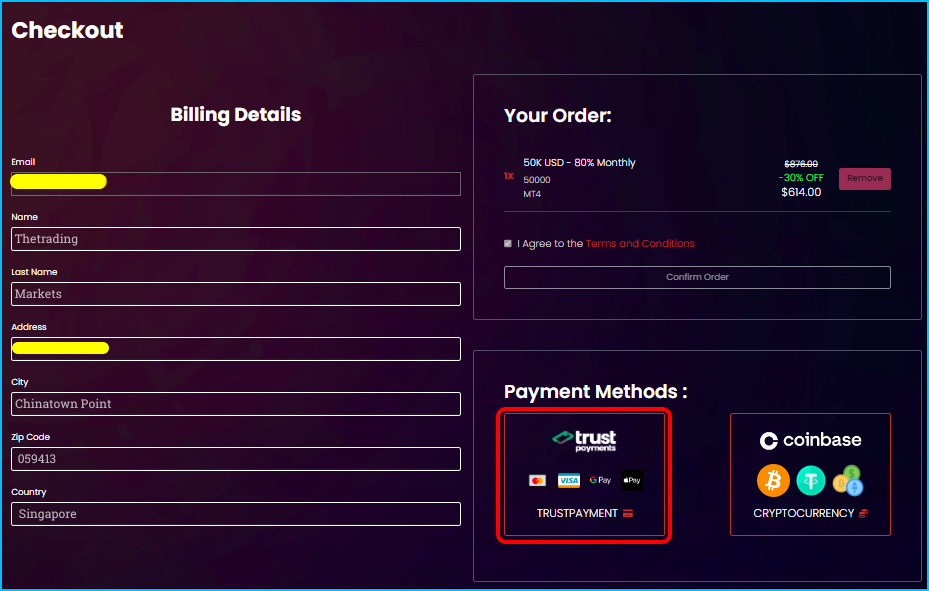

Section 1: select the profit payment mode.

Section 2: select the account size.

Section 3: select the currency.

Suppose, you want to join the 80% Instant Monthly account with the size of 50,000 USD, you select as shown above and click on “Buy Account”

Here, you complete the missing information and click on “Confirm Order” then you choose the payment method.

For a quick payment process, you should choose to use a Credit/Debit card by clicking on the “TRUSTPAYMENT” box

Fill in your card information and click “Pay Securely” to complete the process.

All information about your order will be sent to you via email. If you need OFP’s assistance, you can chat online on the website or send an email to: [email protected]