Contents

- Introduction to Take Profit Trader

- Features and Trading Rules

- Comparison Between Pro and Pro Plus Accounts

- Take-Profit Trader: Funding Discount

- Pros and Cons

- Real-World Experience with Take Profit Trader

- Conclusion

- FAQ – Frequently Asked Questions about Take Profit Trader

- Take-Profit Trader: Funding Discount

Introduction to Take Profit Trader

Take Profit Trader is a proprietary trading firm specializing in futures contracts, based in Orlando, Florida, USA. Founded in 2022, Take Profit Trader has quickly established itself as a key player in the futures trading market by offering flexible funding support to professional traders. With funding amounts up to $150,000 and profit splits of up to 90%, Take Profit Trader provides an attractive opportunity for skilled traders seeking to grow their trading accounts.

The firm supports trading in a diverse range of assets, including equity futures, forex futures, agricultural futures, energy futures, interest rate futures, and metal futures. Thanks to its comprehensive support and flexible rules, Take Profit Trader has become a top choice for many traders in 2024.

Features and Trading Rules

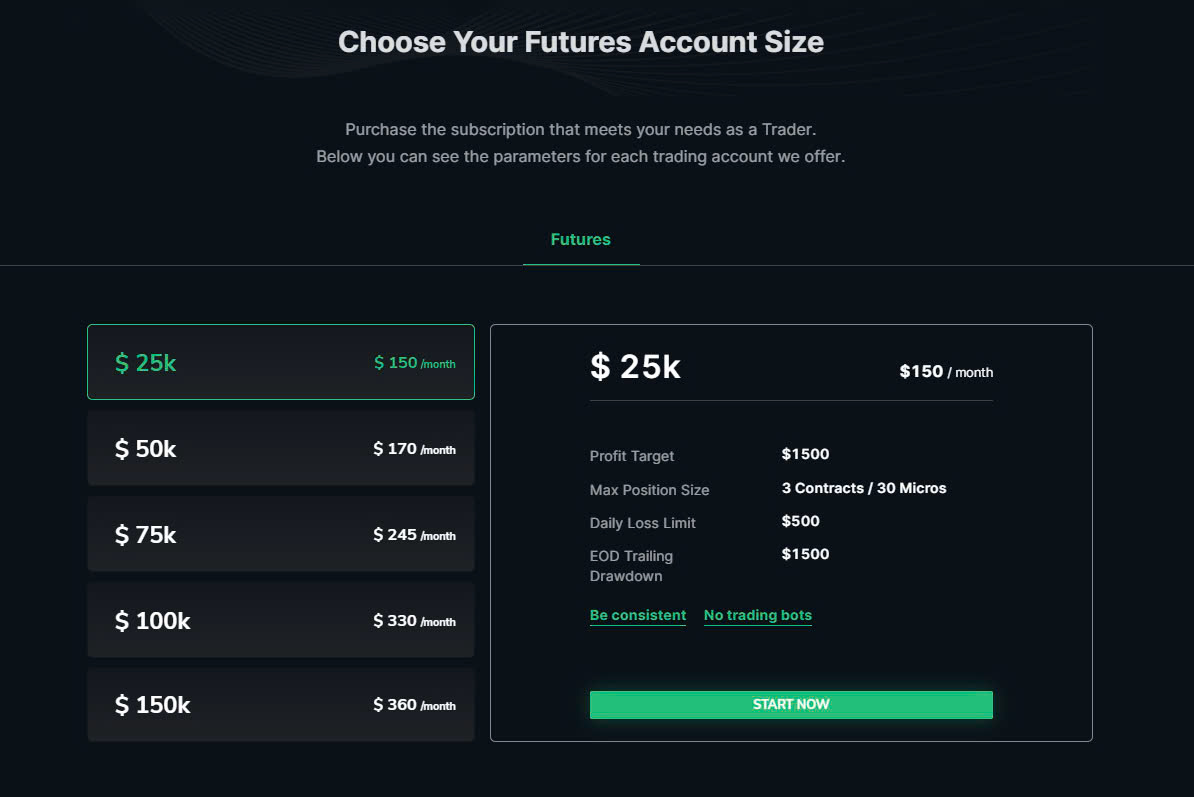

Take Profit Trader not only provides funded trading accounts but also offers clear and reasonable trading rules. Traders must adhere to the following requirements to qualify for a funded account:

- Minimum Trading Days: 5 trading days.

- Profit Target: 6% of the total account balance.

- Daily Loss Limits and End-of-Day Drawdown: These vary by account size, ranging from 2% to 6%. For example, the $50,000 account has a daily loss limit of $1,100 and an end-of-day drawdown limit of $2,000.

- News Trading Rules: All trades must be closed before major news events, such as FOMC, Non-Farm Payroll, and CPI, to ensure risk management.

Additionally, Take Profit Trader only permits day trading, meaning positions cannot be held overnight or over weekends. This enhances risk management and ensures liquidity in trading. One notable point is that the company does not impose a time limit for completing the evaluation, allowing traders to trade at their own pace, providing flexibility in the evaluation process.

Comparison Between Pro and Pro Plus Accounts

Take Profit Trader offers two types of funded accounts after passing the evaluation: Pro Account and Pro Plus Account.

- Pro Account:

- Operates in a simulated environment.

- No monthly data fees.

- Trailing drawdown follows unrealized profits until the starting balance, after which it is removed.

- Profit split: 80% trader / 20% firm.

- Pro Plus Account:

- Operates in a live market environment.

- Includes a monthly data fee of $135.

- No daily loss limit, but trailing drawdown still applies.

- Profit split: 90% trader / 10% firm.

The Pro Plus account is ideal for traders who prefer trading in live markets and are willing to pay a monthly fee in exchange for a higher profit split and no daily loss limit.

Take-Profit Trader: Funding Discount

Pros and Cons

Pros:

- Fast payment processing: Take Profit Trader stands out with its quick payout processing, which takes just 4 hours after the request is approved.

- Profit withdrawal from day one: There’s no need to wait or achieve a minimum number of profitable days to withdraw funds.

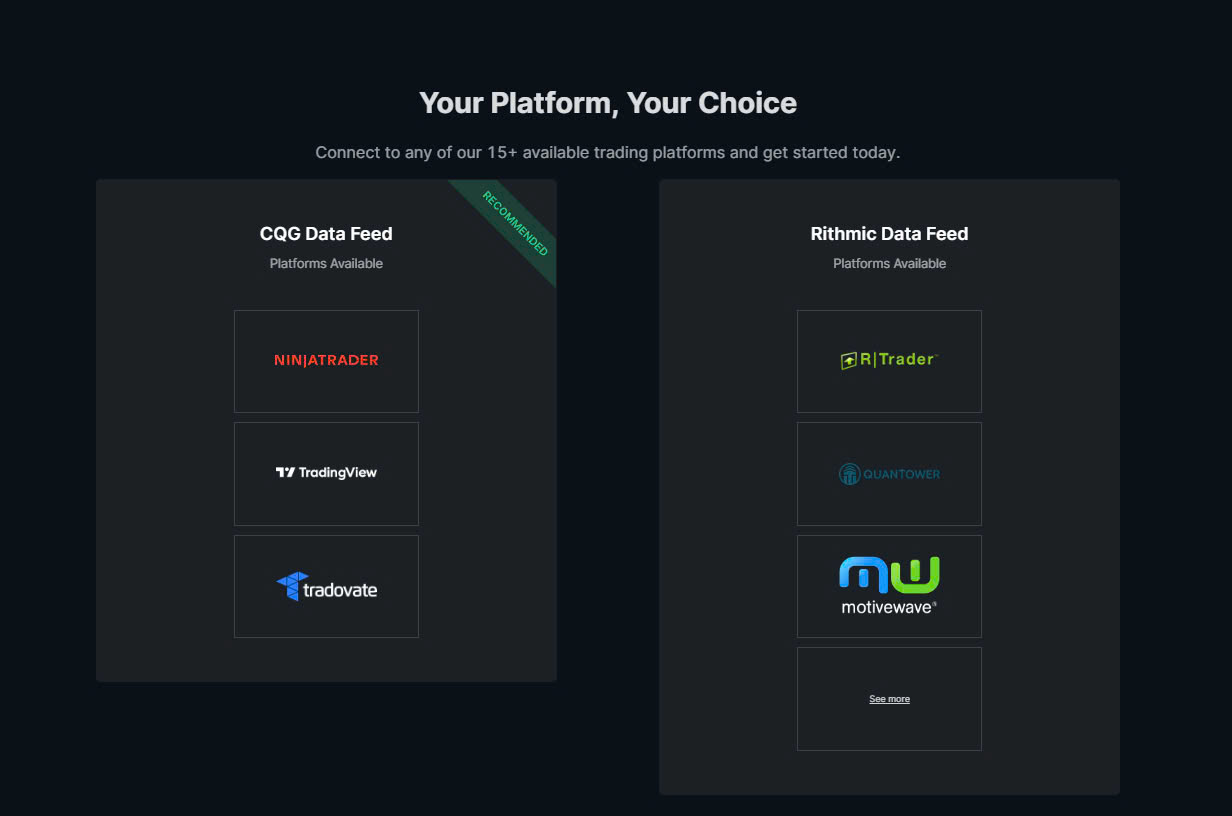

- Multi-platform support: Take Profit Trader supports various trading platforms such as NinjaTrader, Tradovate, Rithmic, TradingView, and more, catering to different trading styles.

- Flexible evaluation time: Traders can trade at their own pace, without any pressure to complete the evaluation within a specific time frame.

Cons:

- Day trading only: Positions cannot be held overnight or over weekends, limiting opportunities to capitalize on overnight market movements.

- No automated trading: Take Profit Trader does not allow the use of automated trading bots, requiring traders to make manual trading decisions.

Real-World Experience with Take Profit Trader

Many traders have praised Take Profit Trader for its fast payout system and transparency. Some have reported withdrawing tens of thousands of dollars without any issues. Moreover, the lack of withdrawal limits and profit splits up to 90% make this firm stand out compared to other prop firms.

Conclusion

Take Profit Trader is undoubtedly one of the top choices in 2024 for futures traders seeking funding and a professional trading environment. With clear rules, flexible account options, and fast payouts, Take Profit Trader has proven itself not only as a funding provider but also as a reliable partner for traders’ success.

If you’re looking for a proprietary trading firm with trader-friendly policies and flexible support, Take Profit Trader is definitely worth considering.

FAQ – Frequently Asked Questions about Take Profit Trader

1. How can I avoid blowing up my account with Take Profit Trader?

To avoid blowing up your account, you must strictly adhere to the daily loss limits and end-of-day drawdown rules. Discipline and consistent risk management are key to keeping your account safe.

2. What is the consistency rule in trading?

This rule requires that no single trading day contributes more than 50% of your total profits. It ensures that traders maintain consistent performance across multiple days rather than relying on one big winning day.

3. What account size is best for starting with Take Profit Trader?

The $50,000 account is highly recommended due to its reasonable profit target ($3,000) and end-of-day drawdown limit ($2,500), offering a favorable risk/reward ratio for traders.

4. What trading platforms can I connect to Take Profit Trader?

Take Profit Trader supports many platforms, including Rithmic, NinjaTrader, Tradovate, and TradingView, allowing traders to connect and trade in a way that suits their preferences.

5. What are the payout methods and processing times?

Take Profit Trader is known for its fast payout processing, with requests typically handled within 4 hours after approval. This speed provides convenience and peace of mind for traders looking to withdraw profits.

6. Can I use automated trading with Take Profit Trader?

No. Take Profit Trader does not allow the use of automated trading bots. The firm prefers traders to make independent trading decisions, which promotes flexibility and adaptability in trading.

7. Can I hold positions overnight or over the weekend?

No, Take Profit Trader only allows day trading. All positions must be closed before 5:00 PM ET each day, and holding positions overnight or over the weekend is not permitted.

8. What happens if I violate trading rules?

If you violate rules such as exceeding daily loss limits, holding positions overnight, or trading during restricted news events, your account may be suspended or terminated. It’s crucial to follow all trading rules carefully.

9. Does Take Profit Trader offer a free trial?

No, Take Profit Trader does not offer a free trial. However, there is a 50% discount available through specific links and codes.

10. Are there any requirements for the first payout?

No. Unlike many other firms, Take Profit Trader allows traders to withdraw profits from day one, without requiring a minimum number of profitable days. This is one of the standout features of Take Profit Trader.