A GAP means a price gap that appears on financial charts. When participating in stock trading, you will see a lot of gaps appearing. With forex, this usually only happens in the opening session of the second week, or one of the special cases. So what is Gap? How many types of GAPs are there in financial transactions?

Contents

What is Gap?

The Gap is simply understood as the gap, when the price moves too suddenly to rise too strongly or fall too strongly causing the price to bounce (up/down) higher or lower than the previous candle’s closing price, creating A gap in the price chart, which we are used to calling a Gap.

What time does it usually appear?

Because the forex trading market operates 24 hours a day, with great liquidity, there is less gap than the stock market. However, Gap still appears in some of the following cases: On the first Monday, Saturday, and Sunday which are 2 Forex days without trading, there is shocking news such as US sanctions on Turkey, news related to Brexit, or a tweet from President Trump will also make Gap easier to appear on Monday.

When there is an extremely strong event affecting the financial markets such as news related to the Fed interest rate announcement or banks trying to sell off a certain currency, for example.

On major holidays such as Christmas or the end of the year, when many banks around the world are on holiday, the transaction lacks continuity, which is also a condition for Gap to be created.

Types of Gap appeared on the market

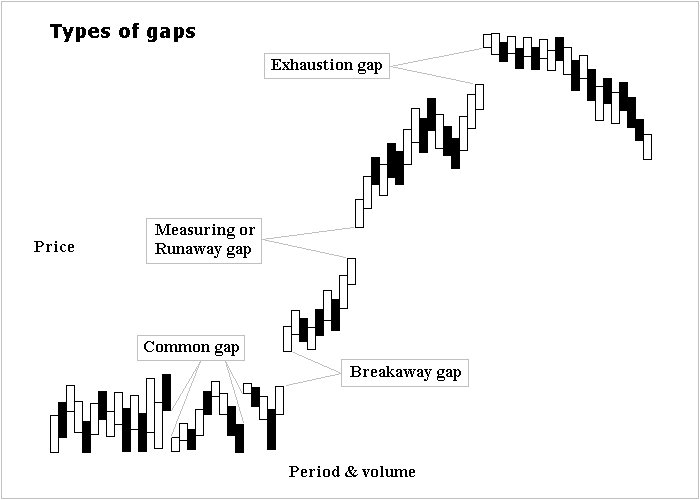

There are 4 different types of Gap that you need to know including:

- Common Gap This is the most common type, mainly appearing at the opening session of the week. Usually, GAP will fill up soon, so it is often used by many traders to trade. But that is not always the case, when trading you still have to scrutinize. In addition, this type of Gap is not too far apart in price and they do not have much meaning in stock and forex trading.

- Breakaway Gap This is a type of Gap that occurs when there is extremely unexpected or strong news, causing investors to change their psychology and turn 360 degrees from the current trend, causing the price to a new trend such as from down to up or vice versa from up to down. It should be noted that this Gap is often not filled, but can instead rush up or down.

- Continuation Gap (Continuing Gap) occurs more often in stocks than in forex when an uptrend or downtrend in stock prices is formed. And Runaway Gap will be like a signal confirming that the trend will continue to take place strongly.

- Exhaustion Gap (Exhaustion Gap, Exhaustion Gap) is similar to Continuity Gap, Exhaustion Gap mainly occurs in the stock market, usually located at the top or bottom after a bullish or bearish trend has formed. A long time ago, when Exhaustion Gap appeared, signaling the end of a trend, it was called the Exhaustion Gap.

When is the Gap filled?

When Gap appears or tends to return to fill. Many traders also often take advantage of these gaps looking to trade to increase their income. However, Gap doesn’t always go up/down to fill Gap. Or will appear at a certain time, not immediately. So you also need to consider carefully to avoid risks.

The gap appears in strong support and resistance areas and will tend to return to these areas. To go retest to determine once again the current price trend before continuing to increase or decrease.

Gaps appear at areas where the price pattern usually fills to complete the pattern.

What is the most affordable way to trade?

There are many ways to take advantage of Gap in trading but you can study some of the points we just mentioned above such as:

Determine if the Gap falls within any familiar resistance, support, or trading patterns. If the Gap coincides with these resistance levels then the price will find a way back to fill the Gap. And also backtest before going up or down with the trend.

With the Exhaustion gap and the continuation gap being the two types of gaps that are easiest to fill. You can find ways to identify the above types of gaps to make them easier to trade.

Also, as I said before, Gaps don’t always fill or they happen at an unspecified time, not during the day. Therefore, you still have to stick to technical and fundamental analysis to trade. You should not just see the Gap and immediately place Buy/Sell orders in the hope that it will be filled to earn a certain profit. Good luck!