What is a buy stop? How to use buy stop order? This is something that any trader is interested in when participating in the forex market. Because buy stop is an effective tool to help investors save time monitoring the market, optimize profits and minimize risks.

Contents

What is a buy stop?

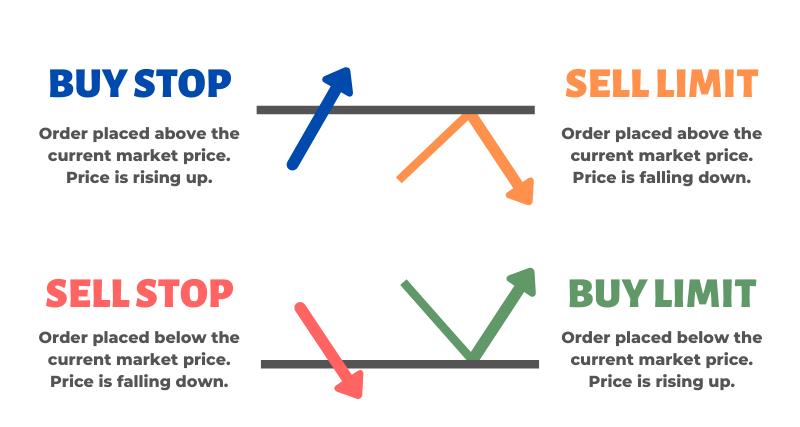

Buy stop can simply be understood as a pending order to buy, but buy at a price higher than the current market price. This is one of the 4 important pending orders in the break-out strategy. Investors will enter an order when the price is higher than the current price.

Because in some cases, when the market price is close to a certain resistance level, investors expect the price to break this resistance area and increase sharply shortly. Therefore, investors will preset Buy stop orders to anticipate this breakout.

Example: The EUR/USD currency pair has a current price of 1.003 very close to the resistance point. You expect this price to break through the resistance point to increase strongly, so enter a buy-stop order at 1.0050. If the price touches this level, the order will be executed automatically.

Meaning of buy stop order

Compared to other forex orders, buy stops are rarely used. Only breakout traders prefer to buy stop orders. Specially, the order is only used when investors want the price to continue to increase and break the resistance area.

If investors do not have much time to monitor market movements, orders will help investors not to miss trading opportunities.

Why use a buy-stop order?

It is one of the types of pending orders indispensable in Forex trading. If used correctly, it will be effective and bring high efficiency. Here are some reasons why you should not ignore this type of pending order:

- Save time monitoring the market: When investors judge the price may break the resistance point and increase sharply shortly. But there is not much time to monitor market movements. At this time, the buy stop pending order will take effect.

- Minimize risk: The forex market doesn’t always go the way you think and when you place a pending order, then the order will not be filled and you will not lose.

Some limitations

Transactions involving money always include two aspects of risk or return. Investing in Forex is the same, when using buy-stop orders there will also be risks when the price does not go in the direction you judge. Sometimes the price just goes up a little and then goes down without reaching the order place, you will miss the trading opportunity.

How to use effectively

Use the nailing strategy

The nail-spreading strategy is a strategy favored by many investors. Accordingly, when trading, you can split the order volume by placing a small order at a distance and spread evenly until the capital is exhausted.

This strategy is not very profitable. But for inexperienced investors, this number is not small. At the same time, when the market only goes up a little and then down, with the nail-spreading strategy, you will not miss a trading opportunity.

Use when the market is sideways

The sideway price will usually move sideways and not have a lot of obvious fluctuations. At this time, the market will be very dull and not many investors will enter the order. However, when the price breaks out of the safe sideway, above the resistance line, this is a good opportunity to place an order.

At this time, investors will place an order a little above the resistance line, a stop loss order below the resistance, and take profit above the entry point. This is a strategy that can help maximize profits by increasing the R: R ratio.