T4Trade gives users all the benefits of trading with a powerful broker, and one of the main reasons traders might pick the broking firm over its rivals is that it allows traders to explore well over 300 instruments from six asset classes, including Forex, shares, commodities, indices, futures, and metals.

Contents

Is T4Trade Legit and Safe?

T4Trade, operated by Tradeco Limited, segregates client deposits from corporate accounts and offers negative balance protection. Founded in 2018, it lacks the longer operational history of many competitors, but my review found no misconduct on behalf of T4Trade, which maintains a clean regulatory track record.

Range of Assets

T4Trade offers a choice of 300+ trading instruments, Forex, commodities, indices, shares, and futures. I like the selection of 84 currency pairs, which ensures that Forex traders have a broad choice of trading instruments, complemented by 26 futures contracts, including 6 currency futures. Equity traders get a selection of blue-chip stocks listed in the US, the UK, and the Eurozone, where Czech companies pleasantly surprised me. I am missing ETFs and cryptocurrencies, but the range of assets at T4Trade suits most retail traders and is excellent for Forex traders. The Fractional share dealing offeris ideal for smaller portfolios.

Currency Pairs

Commodities

Metals:

Indices

Stocks

Oil

Gold

Options, Features, and Synthetics

Equity CFDs / DMA Shares

Maximum Retail Leverage

1:1000

Maximum Pro Leverage

1:1000

T4Trade Leverage

T4Trade maintains a highly competitive and flexible five-tier leverage system where Forex traders get between 1:100 and 1:1000. The higher the trading volume or equity of an account, the lower the leverage, which is an ideal risk management approach for traders and T4Trade. Commodity traders max out at 1:200, index traders at 1:100, and equity traders at 1:20. The T4Trade leverage ensures a competitive trading environment, but traders should deploy proper risk management to avoid magnified trading losses. Negative balance protection exists, meaning traders can never lose more than their deposits.

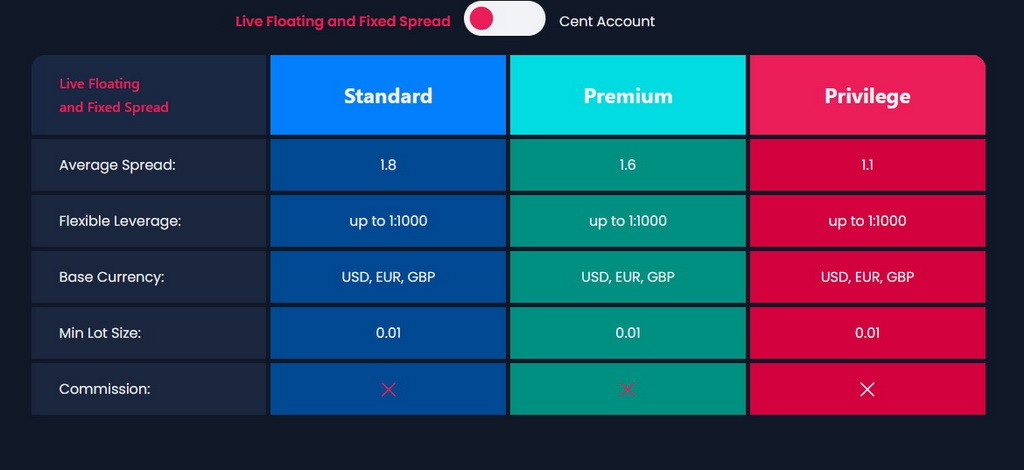

Account Types

Traders may choose from three account types, where the only visible difference is a difference in trading fees. The minimum deposit is $50. A Cent account is also available, which I recommend to beginners to learn how to trade in live trading conditions. Available account base currencies are USD, EUR, and GBP.

T4Trade offers customizable demo accounts, and I did not find a time restriction, which is good, and how demo accounts should function. I recommend traders select demo account settings similar to their planned live deposits to create the most realistic demo trading experience.

Trading Platforms

T4Trade presents its proprietary web-based trading platform, accessible from the client portal, a mobile app, and the MT4 trading platform, which remains the undisputed industry leader. Mt4 fully supports algorithmic trading from its desktop client and has an embedded copy trading service. Regrettably, T4Trade does not offer third-party plugins for MT4. Traders can browse the 25,000+ custom indicators, plugins, and EAs available for MT4, but the quality upgrades are not free. I am missing an introduction to the proprietary options, as T4Trade does not list any features and only notes how to access or obtain them.

Unique Features

T4Trade focuses on its core trading environment, and my review did not uncover unique features, but I do applaud the pricing transparency.

Customer Support

T4Trade notes 24/5 customer support in 30+ languages, but I only came across e-mail support during my review. The FAQ section left me unsatisfied and searching for answers elsewhere. Live chat is supposed to exist, but I could not find it.

Payment Methods

T4Trade guarantees that its clients will be able to top up their accounts and withdraw their funds quickly and easily as there is a good range of deposit and withdrawal methods to decide between.

T4Trade allows its clients to use a number of time-efficient and convenient deposit methods like Visa, Mastercard, and Maestro-branded debit and credit cards, Neteller, Skrill, and Paysafecard. Other payment methods traders can use to transfer money to their accounts are Sofort Banking, Rapid Transfer, bank transfers, Apple Pay, Perfect Money, open banking, and cryptocurrencies.

As for withdrawals, clients of the brokerage firm can make use of most of the payment processors we just mentioned. While transferring funds from your trading account, you need to bear in mind that all withdrawal requests are first reviewed and approved, which might take up to 24 hours.

Deposits and withdrawals come at no cost at T4Trade, but when requesting a cashout via bank transfer, traders should make sure that the amount they are about to withdraw is not less than $300 because otherwise, a fee of $55 will be charged.

The availability of some of these banking methods depends on the location of traders, so the list of options they will get to see when they access their accounts might differ.

The base currencies in which traders can register their accounts are not that many as they can only go for USD, EUR, and GBP. An important thing to note is the range of currencies traders will be given access to will differ depending on the account type they will settle on.

It should be noted that the payment method traders will choose when depositing funds to their accounts should also be used when they want to withdraw their funds.

Bonuses and Promotions

Traders can get three non-withdrawable bonuses, the 100% Supercharger bonus, the 40% Takeoff bonus limited to $4,000, and the 20% Welcome bonus capped at $2,000. Terms and conditions apply, and I highly recommend traders read and understand them before accepting any incentive.

Is T4Trade a good broker?

I like the trading environment at T4Trade for its pricing transparency and balanced asset selection. T4Trade offers beginners a quality introduction to trading via its video course, and the minimum deposit of $50 ensures T4Trade is accessible to traders with smaller portfolios. Forex traders get an excellent asset selection, and I like the availability of fractional share dealing, making T4Trade a solid broker for beginners.