Contents

- I. Fund information

- II. Fund products

- III. Frequently asked questions

- What add-on options are available for For Traders for accounts?

- What happens when I complete my profit goal?

- What documents do I need for KYC verification?

- Am I allowed to merge accounts?

- Can I trade using EA or Indicators?

- Can I copy trades?

- Can I buy 3 $100,000 size accounts and use EA to copy trades between these accounts?

- Can I trade Hedging?

- Can I hold a trade overnight, week after week?

- Can I trade news?

- Am I required to set a stop loss?

- Which broker do For Traders use?

- Can I trade cryptocurrency on weekends?

- Which trading platform can I choose?

- What is the leverage level on For Traders accounts?

- How much are the Commission and Spread fees on the For Traders account?

- How can I pay the funding challenge participation fee?

- Sign up for For Traders here

I. Fund information

What is For Trader?

For Trader is a United Arab Emirates (UAE) funding fund, established in July 2023, initially named Billion Club.

Like other funding funds, For Trader is looking for traders who can generate stable profits in the market.

By passing 2 rounds of challenges, traders will be able to manage capital up to $300,000 via paid fees and $1,500,000 via expansion policy.

The advantages of For Trader are large profit shares, comfortable trading rules, and quick customer support.

The downside is the restriction of copying trades from outside, even if it is your own account.

Contact Info

Website: https://www.fortraders.com/

Discord: https://discord.com/invite/ze9zgt6VJR

Twitter: https://twitter.com/forttraderscom

Email: [email protected]

Headquarter: Goldcrest Executive Building, Office No. 1210, JLT, Cluster C, Dubai, United Arab Emirates.

II. Fund products

Currently, For Trader offers 2 fund products:

– Two-Step Account

– One-Step account

Now we will learn the details.

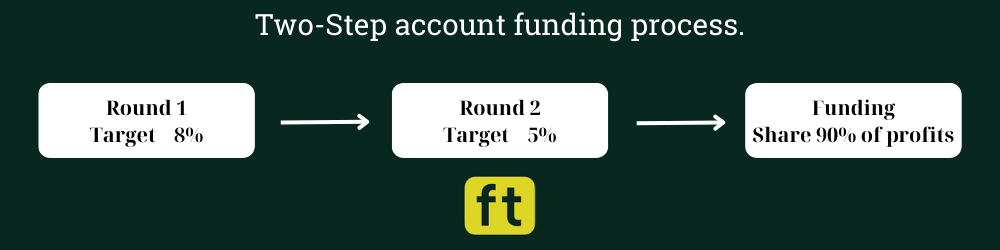

1. Two-Step Account

Two-Step is an account that has 2 rounds of challenges during the evaluation period.

For account sizes and corresponding fees, see the following table:

a. Evaluation phase

During the evaluation phase, you need to pass 2 rounds of challenges.

Round 1

– Profit target is 8%.

– Minimum number of trading days is 3 days.

– Unlimited time.

– Daily decline limit is 4%.

– Account decline limit is 9%.

Round 2

– Profit target is 5%.

– Minimum number of trading days is 3 days.

– Unlimited time.

– Daily decline limit is 4%.

– Account decline limit is 9%.

For example

You join a $100,000 account.

The profit target for round 1 is $8,000 (8%) and round 2 is $5,000 (5%).

Maximum Daily Loss is 4%, determined by Balance at the beginning of the day.

Below are a few cases for you to easily imagine.

#first.

At the beginning of the trading day, the account has Balance = $100,000.

$100,000 – $100,000*4% = $96,000.

During the day, you are not allowed to let your account Equity drop below $96,000.

#2.

At the beginning of the trading day, the account has Balance = $102,000.

$102,000 – $102,000*4% = $97,920.

During the day, you are not allowed to let your account Equity drop below $97,920.

#3.

At the beginning of the trading day, the account has Balance = $99,000.

$99,000 – $99,000*4% = $95,040.

During the day, you are not allowed to let your account Equity drop below $95,040.

The daily loss limit will be reset when a new day begins.

Maximum Loss limit is $9,000 (9% of initial capital).

$100,000 – $9,000 = $91,000.

At no time should you allow your account Equity to drop below $91,000 or a violation will result.

Note: You can easily monitor your account parameters on the For Trader dashboard.

b. Funding phase

Once you pass the evaluation stage, you will receive a funding account. On the funding account there will be no profit target required.

The two rules you need to remember are:

– Daily decline limit is 4%.

– Account decline limit is 9%.

You receive 90% of the profits you generate on your funding account.

Profit withdrawal policy

– The first withdrawal is eligible 14 days after you make your first transaction.

– For the 2nd withdrawal onwards, you can withdraw after 7 days.

Note: Fees will be refunded on the first withdrawal via the method you choose to withdraw profits.

Method of withdrawing profits

For Traders pays profits to Traders via:

– Bank Transfer.

– Crypto (USDC – ERC20), maximum $2,000.

Note: Minimum amount required is $100, maximum amount withdrawn via Crypto is $2,000.

To submit a withdrawal request, you can easily do so on the dashboard under the “Payouts” tab, For Traders will process your withdrawal request within 2 business days.

Capital expansion policy

For Traders will evaluate your funding account every 4 months, if the account is profitable you will receive a 25% increase in initial capital.

For example:

$100,000 funding account

1st capital expansion: $100,000 + $25,000 = $125,000

Second capital expansion: $125,000 + $25,000 = $150,000

….

Maximum expansion capital is: $1,500,000.

The difference in For Traders’ expansion policy compared to other funding funds is that they do not require a minimum profit within a 4-month period.

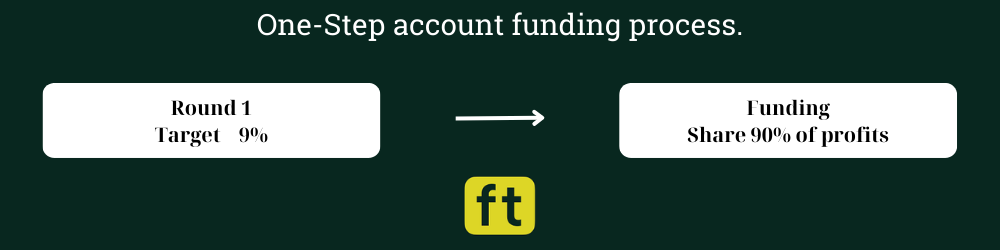

2. One-Step Account

One-Step is an account with only 1 challenge round during the evaluation period.

You need to pay attention to the way One-Step account decline limit is calculated differently from Two-Step.

For account sizes and corresponding fees, see the table below:

a. Evaluation phase

During the evaluation phase, you need to pass 1 round of challenges with the following requirements:

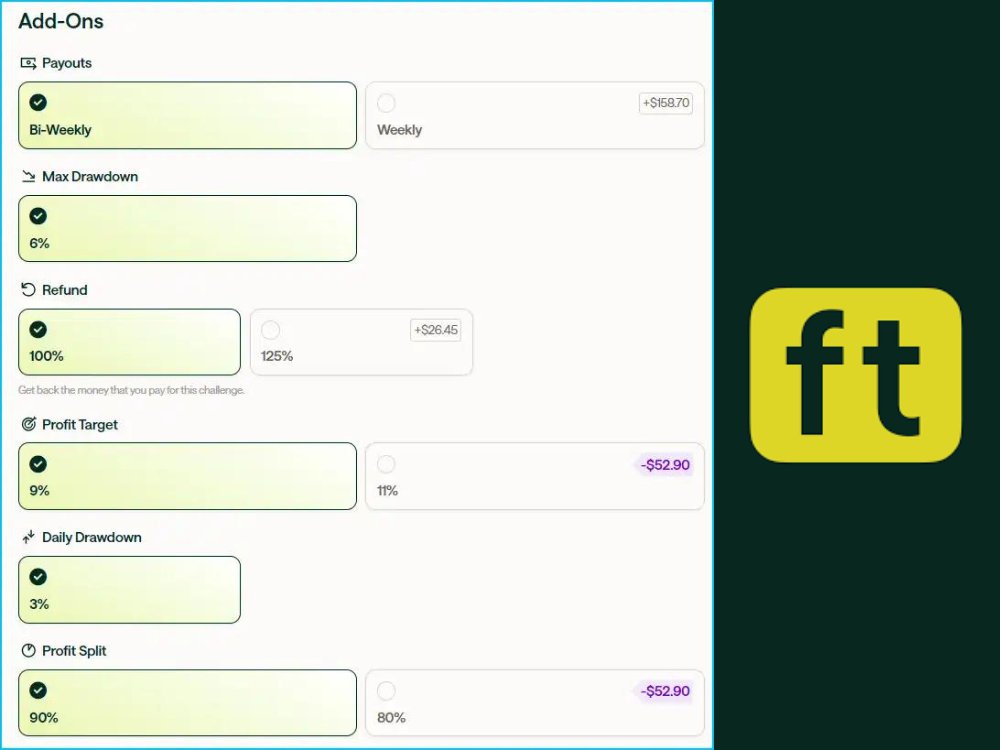

– Profit target is 9%.

– Minimum number of trading days is 3 days.

– Unlimited time.

– Daily decline limit is 3%.

– Account decline limit is 6%.

For example:

You join a $100,000 account.

Profit target is $9,000 (9%)

The daily loss limit is 3% according to the Balance at the beginning of the day, the calculation is similar to the Two-Step account.

The account decline limit is 6% based on the highest Balance level you have ever achieved.

A few cases for you to easily imagine.

#first.

On the 1st trading day, the account has Balance = $100,000.

$100,000 – $100,000*6% = $94,000.

At this time, you are not allowed to let your account Equity drop below $94,000, otherwise it will lead to a violation.

#2.

On the second trading day, you made a profit of $6,000, the account recorded the highest Balance of $106,000.

$106,000 – $106,000*6% = $97,760.

At this time, you are not allowed to let your account Equity drop below $97,760.

#3.

You trade and continue to make more profits, until the loss limit reaches $100,000 equal to the initial capital it will be fixed.

This means, no matter how much profit you make, the highest recorded Balance level is 109,000, 110,000…, the account reduction limit is still $100,000.

b. Funding phase

After completing the evaluation period, you will receive a funding account.

The 2 main rules you need to remember are:

– Daily decline limit is 3%.

– Account decline limit is 6%.

You will also receive 90% of the profits you generate on your funding account.

Just like the 1-round accounts of other funding companies, the drawdown limit will not be reset to the beginning when you withdraw profits, so you need to take back a portion of your profits to make the account work.

For example:

You get a $100,000 One-step funding account, you generate $7,000 in profit, the account records the highest Balance of $107,000.

At this time, the account reduction limit is $100,000 (equal to the initial capital).

If you withdraw $2,000, you will have a margin of $5,000 before reaching a default.

If you withdraw $3,000, you will have a margin of $4,000 before reaching a default.

If you withdraw $4,000, you will have a margin of $3,000 before reaching a default.

With this policy, you should withdraw money when the account decrease is fixed at the initial capital to avoid disadvantages that can easily lead to violations.

Profit withdrawal policy

Similar to Two-Step account

Method of withdrawing profits

Similar to Two-Step account

III. Frequently asked questions

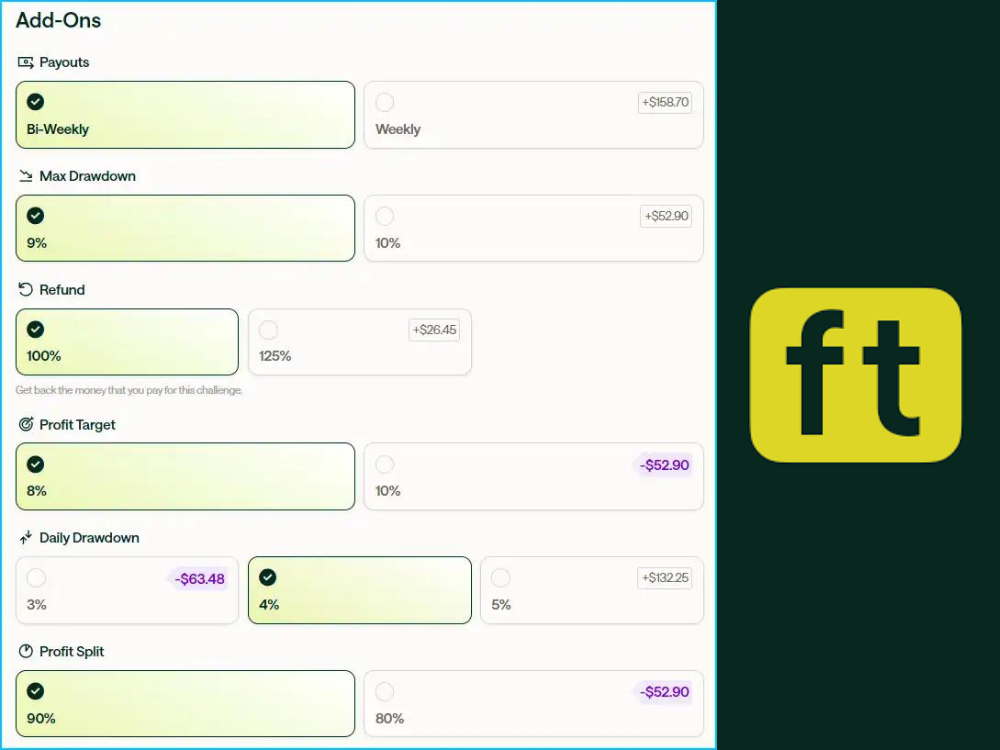

What add-on options are available for For Traders for accounts?

For Trader offers the following add-on options

Two-Step Account

Payout: Pay profits every 2 weeks (Bi-Weekly) or once a week (Weekly).

Max Drawdown: Account drawdown limit is 9% or 10%.

Refund: 100% or 125% refund.

Profit Target: Round 1 profit target is 8% or 10%

Note: If you choose a profit target of 10%, the profit target for round 2 will be 7%.

Daily Drawdown: Daily drawdown limit of 3%, 4% or 5%.

Profit Split: Divide profits by 90% or 80%.

One-Step Account

In general, the higher the fee you pay, the more benefits your account has.

What happens when I complete my profit goal?

If you complete round 1 or round 2 you will automatically move to the next stage.

In fact, if you meet the eligibility criteria and move on to the next stage of the challenge, the account will be closed and you will receive your new account information in email.

What documents do I need for KYC verification?

To perform KYC verification, you need to provide the following documents:

– Identity verification documents: you can use your ID, passport or driver’s license.

– A Selfie photo.

Am I allowed to merge accounts?

Currently, For Traders does not support funding account consolidation.

Can I trade using EA or Indicators?

Yes, you can use EA or Indicator for trading.

Can I copy trades?

Yes, specifically you are allowed to use your For Traders account to copy it to another personal account or funding company account.

You are not allowed to copy from your personal account or other funding company account to For Traders’ account.

In short, you are not allowed to copy trading signals from an external account to the For Traders account issued to you.

Can I buy 3 $100,000 size accounts and use EA to copy trades between these accounts?

Yes, you can.

Can I trade Hedging?

Yes, you are allowed to trade Hedging in one account.

Hedging on two or more accounts at the same time is not allowed.

Can I hold a trade overnight, week after week?

Yes, you are allowed.

Can I trade news?

Yes, you can trade the news.

Am I required to set a stop loss?

No, you don’t have to set a stop loss.

Which broker do For Traders use?

For Traders accounts are powered by Purple Trading.

Can I trade cryptocurrency on weekends?

No, the reason is that Purple Trading’s servers are not available on weekends.

Which trading platform can I choose?

You can choose MT4 or MT5.

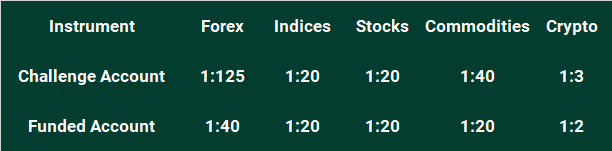

What is the leverage level on For Traders accounts?

For specific leverage levels on trading products (Instruments), please see the following table:

On funding accounts the leverage for Forex will be lowered to 1:40.

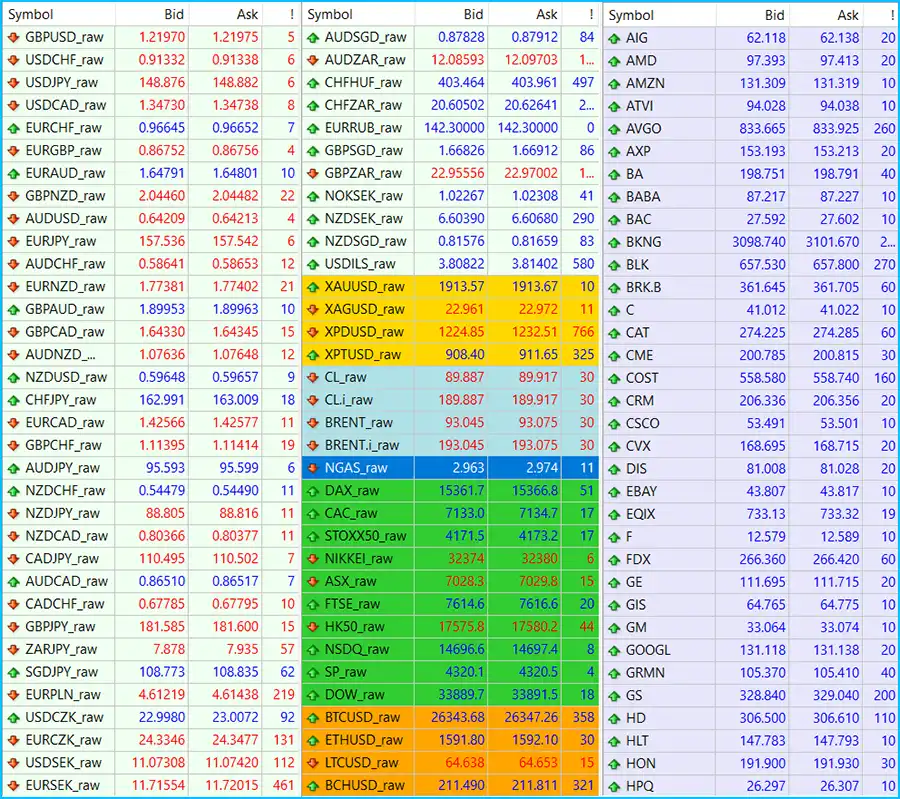

How much are the Commission and Spread fees on the For Traders account?

Commission fees are as follows:

– Forex, Metal, Commodities are $5/lot

– Stocks are $6/lot.

– Commission-free Indices & Crypto.

You can refer to the following table for spread level:

How can I pay the funding challenge participation fee?

You can pay with:

– Visa/Master card.

– Crypto.

IV. Instructions for registration and payment

To register for the For Traders funding challenge, click here

Sign up for For Traders here

Above is all information about the For Traders fund for your reference. If you have any questions, please leave a comment below.