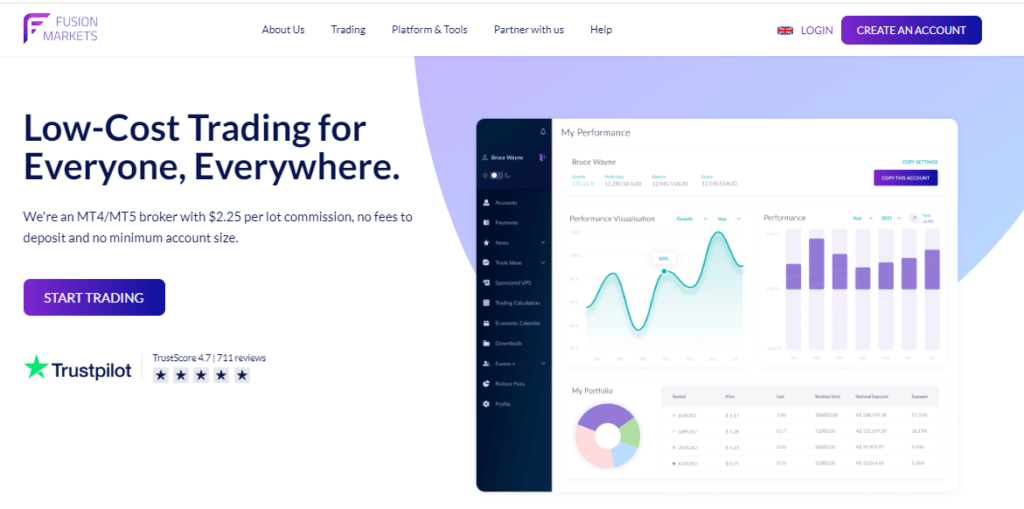

Fusion Markets, based in Melbourne, was launched by veterans of the Australian FX sector in 2017. Its objective is straightforward — to provide a high-quality trading platform at low costs compared to its competitors.

Contents

What is Fusion Markets

Fusion Markets is a fantastic well-regulated forex broker with an affordable trading and non-trading fee structure. Account creation is quick and simple, and customer support representatives respond quickly and accurately. On the other hand, they offer inadequate educational content and no protection for investors. Finally, the product offering is primarily focused on forex pairs and a few CFDs.

REGISTER ACCOUNT AT FUSION MARKETS

Here are some additional details about Fusion Markets:

- Account Types: Fusion Markets offers two main types of trading accounts:

a. Standard Account: This account type is suitable for most retail traders. It offers competitive spreads starting from 0.0 pips and has no commission charges on Forex trades. Traders can access over 90 currency pairs, commodities, indices, and cryptocurrencies.

b. Professional Account: This account type is designed for experienced and professional traders who meet certain eligibility criteria. It provides tighter spreads, reduced margin requirements, and lower commission charges. To qualify for a Professional Account, traders need to meet specific experience, trading volume, and financial criteria.

- Regulation and Safety: Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC). ASIC is known for its strict regulatory standards, which helps ensure the safety of client funds and promotes transparent trading practices.

- Trading Platforms: Fusion Markets supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are widely recognized and offer advanced features, including customizable charting tools, technical indicators, automated trading through Expert Advisors (EAs), and a user-friendly interface.

- Order Execution: Fusion Markets emphasizes fast order execution with minimal slippage. They utilize advanced technology to execute trades swiftly, ensuring that orders are filled at the best available prices.

- Spreads and Fees: Fusion Markets aims to provide competitive pricing to its clients. The broker offers tight spreads, starting from 0.0 pips on major currency pairs. For non-Forex trades, there may be spreads and commissions, which can vary depending on the specific instrument.

- Funding and Withdrawals: Fusion Markets provides multiple funding options, including bank transfers, credit/debit cards, and popular e-wallets such as Neteller and Skrill. Withdrawals are typically processed within 24 hours, and there are no fees charged for deposits or withdrawals.

- Customer Support: Fusion Markets offers customer support services via live chat, email, and phone. Their support team is generally responsive and aims to assist clients with any inquiries or issues they may have.

Pros and Cons

Whatever the broker you’re considering, you can’t start trading with it before being fully informed about its pros and cons. Here are the advantages and disadvantages that you NEED to know before investing your money with Fusion Markets:

Pros:

- Regulation: Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC), which provides a level of credibility and oversight.

- Competitive Pricing: Fusion Markets aims to offer competitive pricing with tight spreads and low commissions, which can be beneficial for traders looking for cost-effective trading conditions.

- Wide Range of Instruments: Fusion Markets provides access to a diverse range of trading instruments, including major and minor currency pairs, commodities, indices, and cryptocurrencies. This allows traders to have a variety of options for diversifying their portfolios.

- Advanced Trading Platforms: Fusion Markets supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their extensive charting capabilities, automated trading options, and user-friendly interfaces.

- Fast Execution: Many users have reported fast order execution and minimal slippage when trading with Fusion Markets. This can be crucial for traders who value efficient trade execution and timely entry and exit points.

- Customer Support: Fusion Markets offers customer support through various channels, including live chat, email, and phone. Their support team strives to provide responsive and helpful assistance to clients.

Cons:

- Limited Educational Resources: Some users have noted that Fusion Markets’ educational resources and materials may be relatively limited compared to some other brokers. Traders who rely on educational content may need to seek additional learning resources elsewhere.

- Restricted Geographic Availability: Fusion Markets may not be available to traders from all countries. It’s essential to check whether your jurisdiction is supported before considering an account with them.

- Limited Account Types: Fusion Markets currently offers two main account types (Standard and Professional), which may not cater to the specific needs of all traders. Some traders may prefer more account options with varying features and conditions.

- Lack of Research Tools: Fusion Markets may have fewer research tools and analysis resources compared to larger brokers. Traders who heavily rely on comprehensive research and analysis features may find the offering relatively basic.

- Limited Promotional Offers: Fusion Markets may have fewer promotional offers or bonuses compared to some other brokers. Traders who actively seek bonus programs or promotional incentives may find fewer options available with Fusion Markets.

Account Types

Fusion Markets makes the clients choose from 2 types of accounts, which are the Classic account and Zero account, both of which differ in terms of pricing.

Since spreads start at 0 and the commission is $4.50 per round, the Zero account offers better terms. The Zero account will be ideal if you’re adopting an active trading style. With Classic Accounts They include the commission in the spread, and spreads begin at 0.8 pips.

There are also corporate accounts offered by Fusion Markets.

Offering of Investments

While Fusion Markets is a forex broker, it still offers some CFDs as well. The broker has a large currency pair selection. In fact, they are one of the largest among forex brokers. Stock index CFDs, commodity CFDs, stock CFDs, and crypto are all available to trade. ETF and bond CFDs, on the other hand, are not offered by Fusion Markets. Stock CFDs are provided only on the MT5 platform.

Fusion Markets allows you to modify your leverage levels, which is truly fantastic. If you want to reduce the risk of your trade, changing your leverage is a very handy function. You need to be aware when trading forex and CFDs because the leverage levels are set high.

Fees – Commissions and Spreads

Fusion Markets claims to be the lowest-cost trader in the industry, and a quick check of its commissions and spreads appears to support this claim. On a number of prominent currency pairs, including AUD/CHF, AUD/CAD, AUD/JPY, AUD/USD, and AUD/NZD, Fusion Markets offers minimum spreads of 0.00. And if we look at the average spreads of the broker, we see numbers like 0.22, 0.48, 0.65, 0.92, and 1.01. Plus, their commission charges are extremely low. We have a full list of low spread trading platforms here.

REGISTER ACCOUNT AT FUSION MARKETS

So, Fusion Markets can be an ideal broker if you’ve been looking for a low-cost alternative compared to most other brokers in the industry.