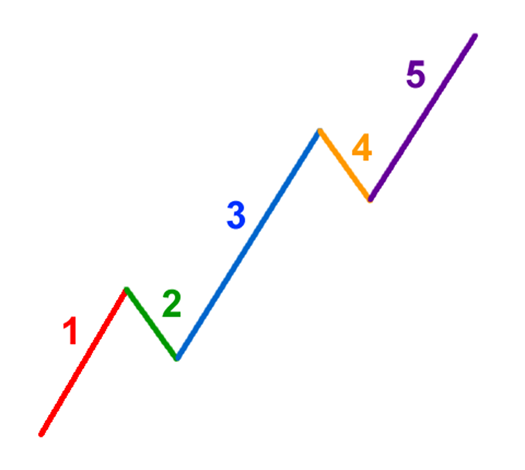

The genius Elliott pointed out that the market tends to move in a direction he calls a 5-3 wave pattern. The first five-wave pattern is called impulse waves. The last 3 wave pattern is called corrective waves. In the pattern, waves 1,3,5 are moving waves, meaning it goes with the overall trend, while waves 2 and 4 are corrective.

Example 5 impulse wave pattern:

An interesting point is that Mr. Elliott initially applied his theory to the stock market. But then, it is widely used for many other fields such as currencies, bonds, gold, and oil… and is especially useful for the forex market.

So what do the above waves mean?

Wave 1

Stocks have initially rallied. It is usually created by a small group of investors who for some reason believe that sooner or later the stock will go up in price. So they feel the stock is cheap and now is the best time to buy, which in turn pushes the stock price higher.

Wave 2

At this time, many people buying stocks thought that the price was too high and they took profits. This pushes the stock price down. However, it will not be able to return to the original level.

Wave 3

This is usually the longest and strongest wave. The stock has caught the attention of the crowd. Many people see the potential of the stock and want to buy it. As a result, stock prices rose sharply. And at wave 3, the price usually exceeds the breakout of the high made at the end of wave 1.

Wave 4

Traders take profits because the stock is, again, seen as a bargain. The wave now tends to be weak because many people want to gauge the growth of the stock and wait to “catch the bottom.”

Wave 5

This is the time when most people participate in the stock market with the pull of the crowd. At this point, you will see any place, any place talking about this stock. And you also often see emerging CEOs appearing in famous newspapers becoming the person of the year.

Investors and traders give countless (sometimes absurd) reasons to recommend that people buy stocks. This helps push the stock price up. Meanwhile, some people started to sell their stocks and formed an ABC pattern.

Extended impulse wave pattern

One thing you need to know about Elliott’s theory, 1 out of 3 impulse waves (waves 1, 3, and 5) always have an “expanding” phenomenon. Simply put, there will always be one wave that is longer than the other 2, no matter to what extent. According to Elliott, the fifth wave is often seen as an extension. However, traders have recently suggested that wave 3 is an extension.