So you’ve heard about NextStepFunded, the new trading platform that promises to help you achieve financial freedom through passive income. Maybe a friend told you they’re making money hand over fist or you saw an ad on social media about someone who retired in their 30s thanks to NextStepFunded. It all sounds too good to be true, right?

You’re smart to be skeptical. As with any investment opportunity, you need to go in with your eyes wide open. We’ve done a deep dive into NextStepFunded to give you the unvarnished truth about how it really works. We’ll tell you about both the upsides that could help you achieve solid returns and the downsides that could derail your investment. Most importantly, we’ll help you decide if NextStepFunded is the right choice for your financial goals or if you’re better off investing your money elsewhere.

By the end of this review, you’ll have the knowledge you need to make a fully informed choice about whether to sign up for NextStepFunded. The only question is: are you ready to learn the truth about the platform, for better or for worse? If so, read on.

Contents

What Is NextStepFunded? An Overview of the Trading Platform

NextStepFunded is an online trading platform where you can buy and sell various assets like stocks, bonds, ETFs, options, futures, and forex. Think of it as a one-stop shop for all your investing needs.

How It Works

To get started, you open an account on their website or mobile app. NextStepFunded offers several account types depending on your investing experience, from beginner to advanced traders. Once your account is funded, you can start trading right away.

Buying and selling assets is simple. Their platform makes it easy to search for, compare, and review investment options so you can find opportunities that match your financial goals. NextStepFunded also provides useful tools for analyzing the performance of your portfolio and the overall market.

The Good

NextStepFunded is very affordable. They don’t charge any commissions or monthly fees to use their platform. You’ll only pay small trading fees when you buy or sell assets. They also frequently run promotions offering free trades for new members.

Their platform is user-friendly and great for beginners. But it also has advanced tools for more experienced investors. So whether you’re just getting started or have been trading for years, NextStepFunded has something for you.

Overall, NextStepFunded makes investing straightforward and accessible. With low costs, an easy-to-use platform, and educational resources to help you learn, it’s a solid choice for any investor.

The Pros of Using NextStepFunded for Trading

When it comes to trading platforms, NextStepFunded has a lot going for it.

Low Fees

Compared to other brokers, NextStepFunded charges very competitive rates. They don’t charge any commissions for stock, options or ETF trades. There are also no maintenance or inactivity fees. The only fees you’ll pay are standard SEC and FINRA fees on sell orders. This can save you hundreds or even thousands per year in trading costs compared to other platforms.

Easy to Use

The NextStepFunded platform is intuitive and user-friendly. Even if you’re new to trading, you’ll find it easy to navigate. The dashboard lays out your watchlists, charts, news feeds and account details in a clean, uncluttered interface. Placing trades is a breeze, whether you’re on the web platform or mobile app.

Robust Resources

NextStepFunded provides helpful resources for traders of all skill levels. You’ll have access to free stock reports, ratings, and price targets to help guide your investing decisions. There are also useful tools like profit loss calculators, margin calculators, and volatility indicators. For new traders, NextStepFunded offers virtual trading, video tutorials, blog posts and a large knowledge base.

24/7 Customer Support

If you ever get stuck or have questions, NextStepFunded’s customer support team is available 24 hours a day, 7 days a week. You can contact them by phone, email or live chat and in most cases get a response within minutes. The support staff are knowledgeable, friendly and able to address concerns thoroughly and promptly.

Overall, NextStepFunded delivers an excellent trading experience with low costs, an intuitive platform, useful resources for traders, and best-in-class customer support. For these reasons, we highly recommend giving NextStepFunded a try.

The Cons and Drawbacks of NextStepFunded

While NextStepFunded does have some appealing benefits, there are also a few downsides to be aware of before signing up.

Fees

NextStepFunded is not free to use. They charge monthly subscription fees for access to tools, data, and the community. The fees range from $49 to $299 per month, depending on the plan. For new traders, these costs can add up quickly. Some competitors do offer free plans with more limited features.

Complex Interface

The NextStepFunded platform provides a lot of data and resources for traders, but the interface can be complicated to navigate. There are many menus, dashboards, alerts, and charts to keep track of. The learning curve is steep, and it may take time to become familiar with all the features. This can be frustrating for new users looking to get started quickly.

NextStepFunded offers limited customer support. They mainly rely on online knowledge bases, FAQs, and community forums to help users. If you encounter an issue, it may take time to get a response. Phone support is only available for high-tier subscription plans. For new traders, comprehensive customer support is important when learning a new system.

Volatile Community

The NextStepFunded community forums contain a mix of helpful and harmful information. Some users share valuable tips and strategies, but others promote risky practices. Moderation seems limited, so you have to be discerning about which advice to follow. For new traders, it can be hard to distinguish good guidance from bad.

While NextStepFunded is a popular platform, make sure to go in with realistic expectations about the potential downsides. The costs, complexity, lack of support, and volatile community may pose challenges, especially for beginners. If you understand the limitations upfront, though, NextStepFunded can still be a useful resource for active traders looking to expand their knowledge and strategies.

NextStepFunded Features and Offerings

NextStepFunded offers quite a few useful features for traders. Here are some of the major offerings and tools you’ll have access to.

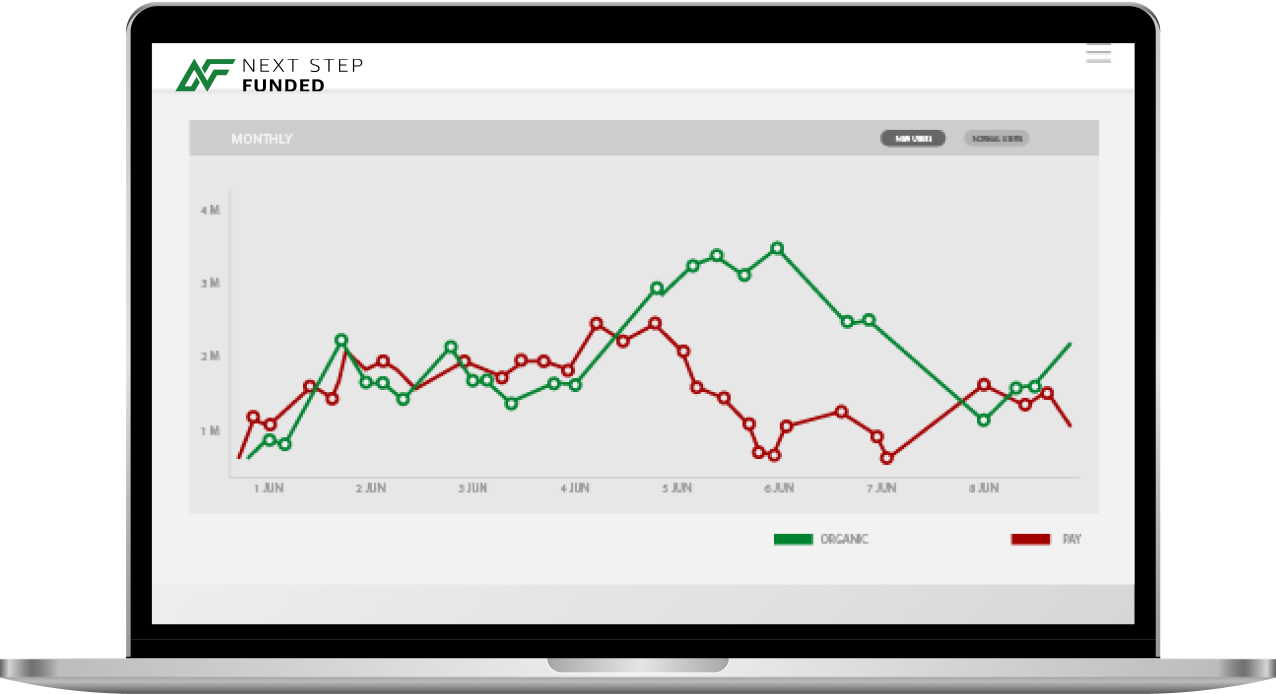

Charts and Analytics

NextStepFunded provides customizable charts with over 100 indicators like moving averages, Bollinger bands, and pivot points to help you analyze the markets. You can view historical data and set alerts for when the price of an asset hits certain levels.

Automated Trading

If you want to take the guesswork out of trading, NextStepFunded offers algo trading systems. You can choose from pre-built algorithms or create your own automated trading strategies. The platform will place and monitor your trades for you based on the strategy’s criteria. This can be a good option if you’re new to trading or want to free up your time.

Social Trading

The social trading feature allows you to see what other traders are doing and even copy their trades automatically. You can view top traders’ portfolios and stats to find those with a good track record, then choose to copy all or some of their trades. This crowd-based approach to trading can lead to good returns, though of course, there is always a risk of loss.

Mobile Apps

NextStepFunded offers mobile apps for Android and iOS so you can trade on the go. The apps provide the same capabilities as the desktop platform, including charts, watching lists, account management, and trading tools. This flexibility can be useful, especially if there are market-moving events during the day while you’re away from your computer.

While NextStepFunded does offer some useful features for new and experienced traders alike, it’s important to do thorough research on any platform before funding an account. Make sure you understand the risks of trading and only invest money that you can afford to lose. With the proper precautions taken, NextStepFunded could be an option to consider.

Is NextStepFunded Right for You? Who This Platform Best Suits

So, is NextStepFunded the right trading platform for you? Let’s consider who this platform is ideally suited for:

Beginner Traders

If you’re just getting started with trading, NextStepFunded is a great place to begin your journey. The simple, intuitive interface makes it easy to navigate and find what you need. You’ll have access to educational resources to help build your knowledge and confidence. Start with a small investment and low-risk strategies to learn the ropes.

Casual or Part-Time Traders

If you only trade occasionally or as a side hustle, NextStepFunded fits the bill. There are no monthly subscription or platform fees to worry about. You can fund your account when you want to trade and withdraw money when you’re done. The flexible, low-pressure environment is perfect for casual trading.

Algorithmic Traders

Do you love analyzing markets, spotting trends and building trading bots or algorithms? NextStepFunded provides an API that makes it simple to connect your algorithms and automation tools. Backtest strategies, optimize your bots and let them trade for you. For tech-savvy traders, this platform is ideal.

Low Fees

If low-cost trading is your top priority, you’ll appreciate NextStepFunded’s zero commissions and minimal fees. All trades are free, and you’ll only pay small financing charges for leveraged positions held overnight. For the budget-conscious trader looking to keep more money in their pocket, NextStepFunded delivers.

In summary, NextStepFunded suits beginner traders looking to learn, casual traders who pop in and out, algorithmic traders wanting an easy API, and traders focused on low-cost or free trading. If any of these describe you, NextStepFunded could be the ideal platform to meet your needs. Give it a try—you’ve got nothing to lose!

Conclusion

So there you have it, a full review of NextStepFunded from sign up to cash out. While the platform offers an easy way to get started trading with a small account, the fees can really add up over time and eat into your profits if you’re not careful. The educational resources are helpful when you’re first learning the ropes, but won’t be enough to make you an expert. Like any trading platform, NextStepFunded has its pros and cons. As with any investment, do your own research to make sure it’s the right fit for your needs and risk tolerance. If you go in with realistic expectations about what it can and can’t do for you, NextStepFunded may be worth a try. But ultimately, only you can decide if the good outweighs the bad.