Perhaps because both provide quality services and do good communication, XM is trusted by many traders.

Contents

Overview of XM floor

Launched in 2009, XM belongs to Trading Point Holdings Ltd, the official management agency of XM is CySEC – the official license provider, in conjunction with the European Union to ensure the exchange is transparent and operating. anti money laundering. Currently, XM exchange is serving more than 2.5 million customers, from 196 different countries, supporting 30 languages, with 16 comprehensive trading software and 25 secure payment methods, with support from 450 professionals with many years of experience in the financial industry.

XM offers a wide variety of products for its clients to choose from, in addition to Forex contracts, CFDs, stock indices, commodities, stocks, metals, and energies. All are open and transparent from spread to commission fees and have no hidden fees, and orders are executed very quickly in less than 1 second. Therefore, XM is loved and chosen by many Japanese traders, who are famous traders who are fastidious, strict, demanding in terms of services.

License to operate XM

This can be considered a reputable forex trading platform licensed by many of the largest financial institutions today, including:

CySEC (Cyprus Securities and Exchange Commission) in Cyprus license number 120/10.

FSC (Financial Services Commission) license number FSC/000261/27.

There is an insurance mechanism in case the floor goes bankrupt

With the license from CySEC, XM will be regulated by the EU’s financial authority, so XM is required to comply with the Financial Instruments Directive 2014/65/EU or MiFID II and the Anti-Laundering Directive. EU money, to protect traders under the Investor Compensation Fund (CIF) with a maximum coverage of €20,000.

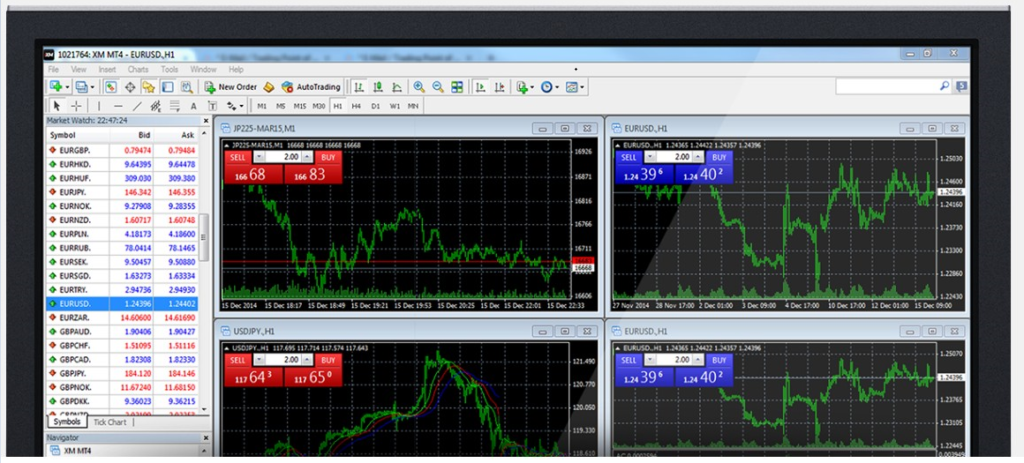

Trading Platform at XM

One of the advantages of XM is that this forex broker offers both MT4 and MT5 trading platforms with a multitude of options such as: compatible with computers running Windows and Mac OS, Webtrader. In particular, XM also develops MT4 and MT5 software that can be compatible with iPad, iPhone, as well as Android, Android Tablet.

Types of trading accounts of XM

Micro account provided by XM

- Minimum deposit 5$

- Spread fee: from 1 Pip

- Commission fee: no

- Maximum number of open/pending orders: 300 orders

- Minimum order volume: 0.01 Volume (MT4), 0.1 Volume (MT5)

- Trading Bonus: Yes

Standard account provided by XM

- Minimum deposit: 5$

- Spread Fee: Only from 1 Pip

- Commission fee: No

- Maximum number of open/pending orders: 200 orders

- Minimum order amount: 0.01 lot

- Trading Bonus: Yes

XM Ultra Low Account

- Spread for major currency pairs: From only 0.6 Pip

- Rose: no

- Maximum number of open/pending orders: 200 orders

- Minimum deposit: 5$

Share account provided by XM

- Base currency USD

- Leverage: No leverage

- Spread According to each base rate

- Commission fee: Yes

- Maximum number of open/pending orders: 50 orders

- Minimum order amount: 1 lot

- Minimum deposit: 10,000$

Trading products offered by XM

XM offers a wide variety of products with over 1000 products. Unfortunately only 1 thing, XM currently no longer supports cryptocurrency trading. Therefore, if you want to trade cryptocurrencies, you can refer to exchanges like Exness or XTB.

- Forex trading: 57 currency pairs – major, cross and exotic

- Stock CFDs: 1184 stock tickers

- Stocks: 100 different types of shares, traded on Share . account

- Commodities: 8 products including: Coffee, Wheat, Sugar, Corn, Cocoa

- Stock indices: 30 indices

- Precious metals: 4 products including gold, silver, platinum and palladium

- Energy: 4 products including: Brent oil, WTI Oil, NGAS, London Gas Oil (GSOIL)